Management & Operation of Healthcare Facilities

Task:

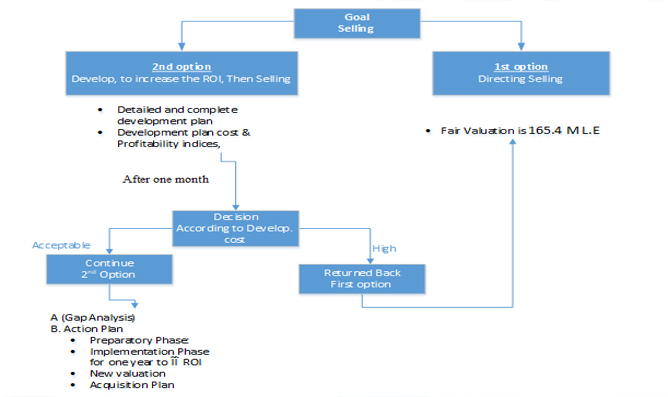

58 bed hospital located in the most prestigious area in Cairo, ROI was 2% of the total investment capital, and the main target was selling the hospital with fair price Asset valuation was 158 M, the average net profit was 3.4 M for the last 3 years, so the fair valuation after profit multiply approximate was 165.4 M We propose for the board our proposal.

Action:

The board agreed for the second option

After a month the development plan result was

1. Development preparation total cost like painting of some department, some process modification. HIS system, etc. will be 6.5 M on credit base for 12 months

2. Development preparation period including the training will be 3 months

3. Net profit After 12 Months of operation will be 57.5 M

4. ROI for the first year will be 35% from the investment capital

5. The fair valuation of investment will be 185.7 instead 165.4 M

Result

Our Development Plan Includes:

1. Gap Analysis (1 Months)

2. Preparatory Phase (3 Months)

3. Implementation Phase (12 Months)

Result After operation for one year was, the net profit 58.2 M

The fair valuation was 186.1 M

The decision was, to continue the operation for additional 2 years to reach the fair valuation of 222.7 M